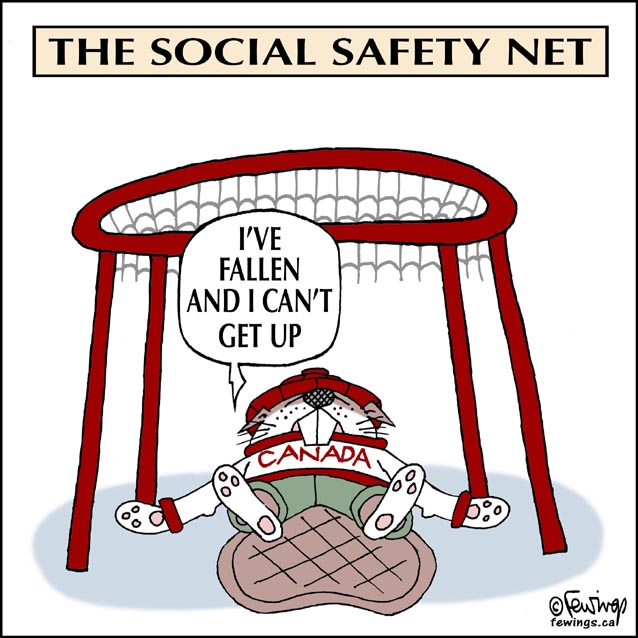

(Image courtesy of John Fewings Cartoons)

The Minister of Finance tabled the budget for Canada on April 7th, and it included some $300M to start a dental care program. CTV News reports that “The new program will be restricted to families with an income of less than $90,000, with no co-pays for those who make under $70,000 per year…The plan is to expand eligibility to children under the age of 18, seniors and persons with disabilities in 2023. The government expects full implementation by 2025, with an annual cost of $1.7 billion“

Now, to be fair, the implementation details are not well understood yet. But the apparent lack of universality of the program is intriguing. First, why would we draw a line at $90k family income for coverage and then draw another line at $70K for the “no co-pays” issue? Who determines what the family income is, and how? Will income tax returns now include all dental care receipts, with applications for return of co-pay fees? Will the bureaucracy associated with determining who fits within that narrow $20K income slice be efficient – will it save the government more on dental care insurance costs than it costs in administering the needlessly complicated parameters of the program?

If you were stuck at a family income of $70.1K, wouldn’t paying co-pays on your dental care program leave you worse off than your neighbour who has an income of 69.95K and has no co-pay fees as a result?

I imagine that the government is trying to establish a gradient so that we don’t go from no benefit to full benefit across a single income line. But all they’ve done is increase the number of people who are pissed off at them. If you have a cut-off line at $90K, everyone between $90K and $100K will be annoyed because they slid over that line. They won’t be any less annoyed if they see that the people between 70 and 90K have to pay co-pay fees. But those people between 70 and 90 will be pissed off that they’re paying those fees. Furthermore, the announced “graded” program still doesn’t achieve anything like equivalent outcomes. The $90K family with six kids is likely to be, overall, worse off than the $70K family with one child and arguably needs the no co-pay provision just as badly.

Governments – they just can’t keep it simple. They’ve just muddied the waters with minimal impact on real costs and added more administrative cost to the program as an unintended consequence.

Here’s another unintended consequence to think about. Who is going to benefit from this program? The NDP/Liberal answer is low-income families. But that answer may be only partially correct. Minister Freeland, in her budget speech, identified that a third of Canadians don’t have dental insurance, which means that two thirds of Canadians do have dental insurance. How does the government propose to deal with low-income people who already have coverage? There are lots of ‘em out there. A website, ca.talent.com, suggests that the average union salary in Canada is about $55K, so many unionized employees will qualify for government dental coverage. But many unionized workplaces have already bargained for dental coverage plans, presumably as a result of some compromise on their total salary.

So, what happens when that $55K unionized worker goes to the dentist? Does the company pay, or does the government pay? If the answer is that the government pays, then effectively the taxpayer pays more, the union employee gets the same dental care she was always getting, and the employer pays less. Is the employee better off? No, not unless they manage to recover the value of benefits in the total compensation package in their next contract. We might just be diverting personal income tax money into increased corporate profits. It will be very interesting to see how the government chooses to deal with pre-existing benefit packages.

On the other side of that coin, of course, is the situation where the company’s plan pays, which means that the employee doesn’t get government subsidized dental care, but his neighbour does. Might he be aggrieved at that lack of support? Why yes, he might.

There are an awful lot of dental care packages out there. We could argue that the company has to continue paying, but wouldn’t both the union and the company simply agree in their next contract to drop dental benefits? The company would be glad to reduce their benefits coverages and the union could argue for some other benefit that filled out their total compensation package. It feels like the low-income person with dental coverage will not benefit from this program really, but a person who took straight salary instead of coverage will get a boost.

Do we just want employers out of dental benefits coverage? Can’t happen. The availability of government coverage for low-income employees will tend to drive companies out of the dental benefits game. But that doesn’t work for the employee who makes $90.1K and currently has coverage. So, companies might have to have a program for some portion of their workforce but not for another group. Complicated.

Unintended consequences. What happens to benefits companies like Great West Life, Manulife and Green Shield Canada? If government intrusion into dental benefits programs leads to unionized companies dropping those benefits, what happens to companies whose main source of income was in acting as the middle-man between the employee and the dentist?

Dental care isn’t the only issue out there. Consider as well the government program to create $10/day child care. (I looked for information on the Ontario program, and apologize to those from other provinces, but I think the Ontario issues will serve to illustrate the general situation.) According to a CBC news article “As of April 1, 2022, families with children five years old and younger in participating licensed child care centres, including licensed home care, will see fees reduced…” Sounds good. But what about folks who have daycare from a non-licenced provider?

You might say “well, we don’t care about that. We want our tax money to go to appropriate, professional daycare services, not to just anyone”. Don’t dismiss this issue too quickly. The Toronto Star notes “According to Statistics Canada, Ontario has roughly 10,937 unlicensed home care providers… In total Canada has 28,250 unlicensed home-based businesses.”

In a separate article, the Star said “At last count (2016) child care was a $6.1 billion business in Ontario, of which 91 per cent was generated almost exclusively by women providing care to children through unincorporated businesses that have no employees. Mostly they are young mothers making money caring for other children while raising their own, or a retired neighbour who has time on her hands.

It’s hard to know how many unlicensed caregivers there are because many operate “off-grid,” providing cash for care; but there were at least 35,000 registered incorporated and unincorporated child-care businesses in 2016, most reporting earnings of less than $10,000 a year. This can be critical income for women who provide care out of their homes. It’s also a critical service for parents and children who have no other options.”

The astute and critical reader will note that the Star has some numbers that need to be reconciled. If Statistics Canada says there are ~ 11000 unlicensed home care providers in Ontario, then how do we suddenly jump to 35000 registered businesses? Answer? I don’t really know and I don’t care. Both numbers say that there are an awful lot of unlicensed daycare providers out there. Maybe many of them are, as suggested above, cash businesses operating as part of the underground economy. I’m not a huge fan of the underground economy, since every tax dodger is taking money from my personal pocket, but they are clearly a part of the daycare picture in Ontario (and in the rest of Canada, I assume).

How will the $10-a-day plan affect that overall picture? Well first, it will put downward pressure on the price of unlicensed home-based daycare, and may drive many such providers out of business. That will decrease the total number of daycare spots available, which will increase the pressure to create more licenced daycare businesses. That in turn will put upward pressure on the salary of daycare workers and create a demand for more workers with Early Childhood education qualifications. In the short term the program is likely to actually decrease daycare availability before the system has time to catch up and create more licensed spots.

OK, you say, but the end result will be good. We’ll have more licenced care facilities and that will be a good thing, won’t it? Will it, really? Setting aside my issues about the underground economy, what’s really wrong with unlicensed daycare? Many, many families are achieving satisfactory results with a caring neighbour who has already raised six kids of her own. Is it really obvious that a “hospital ward” day-care facility where all the 2-year-olds are expected to be ready to nap at exactly the same time will provide better daycare? No, I didn’t think so.

Ontario already has regulations that determine when you need to be licensed – which is if you are caring for more than five children. Implicit in that regulation is that it’s OK to have unlicensed care if the numbers are suitable. Or, to put it another way, Big Brother doesn’t need to closely supervise daycare when you don’t try to put too many kids in one place.

Canada has a Child Tax Credit and many provinces have a related program such as the Ontario Child Benefit. Both of those credits are aimed at low to middle income families with children and have a means test associated with them. The purpose of the low-cost daycare program is to enable career minded parents to return to the workforce and increase the country’s GDP, so the means test is inappropriate for these purposes. But instead of creating a new bureaucracy to deal with government-subsidized daycare, could we not modify these tax credits to put daycare money in the hands of parents and then trust them to find the daycare provider that suits them? And if that means that Molly down the street continues to look after a few kids, is that really so bad?

I have one more. Pharmacare. The Ontario NDP has revealed their election platform for 2022 and have promised Universal Pharmacare. The NDP platform document says “Pharmacare will complement Ontario’s existing public drug programs, so that no one loses their current coverage.” In the unlikely event that the NDP get elected, it sounds like we’ll wind up with much the same patchwork quilt that the dental care program is headed for.

I think there are two or three things at play here. First, because there is already a set of private drug and dental benefit plans in place, governments are keen to try to keep the announced costs of their programs low by filling in gaps as opposed to providing the full cost of the programs. Second, governments are addicted to doing things in a complicated way, because they want to leverage a vote in every possible way they can. Third, governments will do anything to avoid the perception that they are adopting socialism, since that is the next to communism which is right next door to devil worship in the North American right-wing psyche.

I want to deal with the “socialism” issue first. An article on Scandinavian Socialism offered this description of Socialism: “Socialism is a political, social, and economic philosophy encompassing a range of economic and social systems characterised by social ownership of the means of production and workers’ self-management of enterprises.” The Prime Minister of Denmark in a speech at Harvard’s Kennedy School of Government addressed the misperception of the Nordic model for governments when he said “I know that some people in the US associate the Nordic model with some sort of socialism. Therefore, I would like to make one thing clear. Denmark is far from a socialist planned economy. Denmark is a market economy.”

One aspect of the “Nordic Model” noted in the article on Scandinavian Socialism was “Generous social safety net and public pension system with well-funded public services in a relatively high-tax economy.” Why was I interested in the Nordic Model particularly? The reason is that in the EIU Democracy Index for 2021, five of the top six most democratic countries in the world were Sweden, Norway, Denmark, Finland and Iceland. Only New Zealand managed to break the Nordic country stranglehold on the top five democracy ratings. Having a “generous Social safety net” clearly doesn’t prevent a country from being a solid democracy. And nothing about expanding the social safety net implies that we are in any way going to embrace social ownership of the means of production.

Secure in the knowledge that expanding the reach of the welfare state isn’t quite the same as dipping into the deadly waters of socialism, we could probably define a level of social safety net that we believe we should aspire to in this country and make that universal. Universality will help simplify implementation. Universality, in fact, is one of the key principles of the Canada Health Act, and we should question why that principle would apply to the health of our knees and hips, but not our teeth.

With universality will come, inevitably, higher taxes. How high those taxes go depends on what kind of society we value. If we want our streets free of beggars and homeless people, we have to do something about sheltering the homeless. If we want all children to have good teeth, we pay for dental care. If we want them to have flawlessly straight teeth we’ll also pay for orthodontic care. If we believe that dentures are a torture instrument to be inflicted on the aged, we pay for expensive dental implants instead.

I don’t, by the way, believe that we would all want those top-end levels of coverage. I think we’d likely, as a country, be willing to pay for dental coverage. But orthodontics? Only where there was a significant structural problem. As for dentures – not fun, but that’s probably what you’re going to get from the social safety net if I’m driving it. More expensive treatments are for the rich, and yes, I think that people who can afford to pay for care that is better than the “affordable standard care” should be able to do that. It’s their money – more power to them.

It is really not my intention to argue strongly for or against expanding the social safety net. I’m probably inclined to go ahead with it, which is probably a late game reversal of my earlier views on the subject, but that’s not the point of the article. The point is really that if we’re going to do it, we should embrace it and do it properly. Make it universal and simple and try to minimize the associated bureaucracy. And then go ahead and raise the taxes as needed to fund those programs.

Remember that in making the programs universal, you are going to relieve a lot of employers of health care costs for which they are currently responsible. That means that the government should increase corporate income tax rates by at least an amount calculated to recover the cost of existing employer-driven health care programs. Alternatively, to avoid the lying, cheating chartered accountants out there who find a way to zero out corporate incomes, we could apply a straight payroll tax so that employers pay some reasonable fraction of these costs directly. And yes, personal income taxes will also have to go up. If we want programs like these, it is only reasonable to expect that we’ll have to help pay for them. But if we all pay and we all share alike in the benefits, we should be reasonably satisfied with the outcomes.

2 responses to “Expanding the Social Safety Net”

I wonder what dentists are thinking and saying about the proposed Dental Care program? Canadian doctors are not 100% in favour of their status as “government employees” and I doubt if dentists will embrace that role any more enthusiastically.

If 2/3 of Cdns already have dental coverage, it will certainly be tricky to roll out a government program that benefits all Cdns, and not just the corporations which are suddenly relieved of the burden of including dental care in their compensation packages.

Universality seems like the only way to go in terms of who gets coverage. The tax system can take care of evening out who pays more and who gets a tax credit. (More complications for the tax system! Oh no!!!).

Thanks for the comment Terry. I think we are in violent agreement on this one. A government dental care program that is not universal will be a mess.