I drive a “luxury” vehicle. It’s a second-hand, 13-year old Lexus IS 350 with an annoying scratch in the paint on the trunk. It only has about 160K on the odometer, and since I rarely drive more than 15000km/year, it’s likely to do me for a long, long time. However, it takes premium gas, and as I discovered recently on my trip to the Maritimes, we poor luxury car owners are getting ripped off by the gas companies.

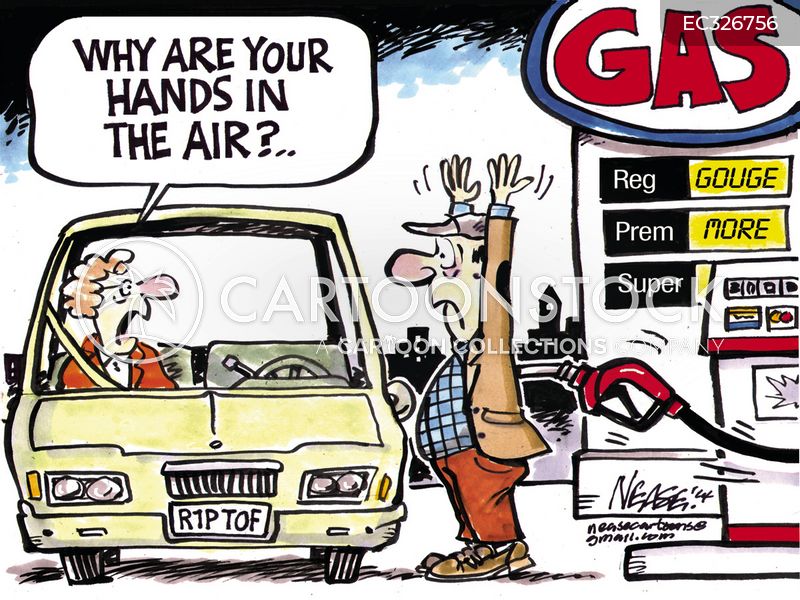

Well, not all of us. It depends on where you live. I was pleased to find on my driving trip that gas on the Island wasn’t greatly more expensive than gas in Ontario, though I’d previously thought it was. And then one day while I was fuelling up I noticed that the premium I pay for using premium gas was only about 13 cents a liter on PEI and I was pretty sure that it would be at least 25 cents in Ontario. Yesterday I fuelled up in Chatsworth, and the difference between regular (87 octane) and premium (91 octane) fuel was 33 cents a liter. The premium premium just keeps going up! It’s time for affluent high-test vehicle owners to rebel!

Today is Friday the 13th of September. (No foreboding mood music please.) I went looking online for a province by province breakdown of the high-test to regular price gap. At first it was difficult to find the information. There are a great many websites that are willing to educate you on how premium gas is different from regular, and even more sites that will tell you the price of regular gas. You have to dig a bit more to get a price on high-test, but eventually, like any dogged researcher, I tracked it down. Here’s the poop, the whole poop and nothing but the poop on gas price gaps:

| City | St. John’s | Halifax | Ch’town | Frederiction | Montreal | Chatsworth, ON | Winnipeg | Regina | Calgary | Vancouver |

| Gap (cents) | 6.4 | 6.9 | 11.5 | 13.6 | 30 | 33 | 27 | 25 | 30 | 25 |

Wow! The premium premium gap ranges from 6.4 to 33 cents. How the heck do we explain that much variation?

My first thought was that it might be that some provincial governments impose a higher tax on high-test gas as a way to discourage the use of higher octane gases, perhaps as a climate control measure. That thought doesn’t hold up under scrutiny. Internet wizards of all sorts are convinced that burning high test doesn’t increase carbon emissions. Indeed, the most common discussion on the subject is an argument that says that if auto manufacturers need to make more efficient, higher compression engines so that oil refiners can provide higher octane gas that can lead to emissions reductions. The American fuel and Petrochemical Manufacturers (AFPM) says “ A standard could be in place well before 2030, and in year one alone, the combination of the new high-octane fuel in optimized, higher compression engines would reduce carbon emissions from light-duty cars and SUVs by 2.69 million metric tons and by 1.11 million metric tons for pickup trucks.”

OK, maybe they’re just taxing the high-test elite higher for the fun of it. But no, that doesn’t appear to be it either. In fact the gas tax system in Ontario is very simple and uncomplicated. The provincial gas tax was 14.7 cents per liter until Doug Ford decided to drop it to 9.0 cents per liter to make Justin Trudeau look bad. There’s no difference between taxes on premium vs regular. Likewise, the federal excise tax (10 cents), Federal carbon tax (17.6 cents) and HST (18.5 cents) on September 9th are all the same for regular vs high test. That’s a total tax load of 55.1 cents/liter in Ontario. Just as a matter of interest, the Canadian Fuels Association (an oil and gas industry interest group) tells us that the average gasoline tax load in 2023 was fairly typically about 53 cents, with BC standing out high at 59.5 and neighboring Alberta holding on to an astoundingly low 30 cents/liter.

So the extra cost of premium isn’t taxes. Is it the cost of refining and the additional additives etc that makes premium gas different from regular? Well, it does seem like refining costs are a little higher, but only a little. Also, because regular gas has a much larger market share, refineries are set up to make more of it and it responds faster to changing demands. But if premium gas can sell at a profit in Halifax with a 7 cent gap (6 and ½ in Newfoundland), then the additional cost of manufacturing is probably not more than 6.5 cents, is it?

The Canadian Fuels Association (CFA) provides a detailed breakdown of the components of gasoline pricing in major cities in Canada. It was interesting to see that the refiners’ operating margin varies between 24.9 cents/liter (Halifax) and 35.8 cents/liter (Winnipeg). Hold the phone though – that statement doesn’t include Vancouver. Refiners’ operating margin in Vancouver is 59.4 cents/liter, or more than double what it is in Halifax. I’m fairly sure that Vancouver refinery workers aren’t being paid double what they are in the Maritimes. I found several reports by Navius Research on the subject of BC gasoline pricing. The 2020 version says “Since 2015, gasoline and diesel prices in the Vancouver area fuel market appear to have decoupled from supply costs, resulting in high prices that cannot be attributed to competitive market forces or scarcity of supply….This apparent lack of competition has cost each household in the Vancouver fuel market roughly $1,700 between the start of 2015 and the end of 2017.” Clever readers will have noticed by now that this has almost nothing to do with the matter at hand, which is the difference between regular and premium gas prices, but I found that Vancouver refiners’ margin data simply astounding and I couldn’t resist dropping it on you. And besides, it does have a little relevance which I’ll discuss just a little later.

The reason why I was looking at the CFA price breakdown data was to look at the Marketing Operating Margin data. I think Marketing Operating Margin is the sum of the retailer’s operating costs (wholesale price plus lease, equipment, sales staff costs) plus profit margin.

| City | St. John’s | Halifax | Ch’town | Fredericton | Montreal | Toronto | Winnipeg | Regina | Calgary | Vancouver |

| MarketMargin | 15.6 | 10.2 | 12.9 | No data | 7.6 | 8.9 | 13.6 | No data | 11.2 | 8.8 |

It’s interesting that there is no real correlation between the marketer’s margin and the premium price gap. Toronto and Montreal have the lowest marketing margins, and among the highest premium price gaps. Charlottetown, Halifax and St. John’s have the highest marketing margins and the lowest premium gap, which argues for an inverse proportionality. But then you look at Winnipeg and Calgary, which are high on both metrics. I can’t make a consistent relationship out of the data. What that suggests is that there is no relationship – that premium gas price is pretty damn arbitrary.

The CFA document has a discussion of gasoline price regulation. It says “many studies and reviews have shown that an open unregulated marketplace is the best way to ensure competitive pricing. Regulated price stability is usually achieved at the expense of higher prices at the pump.” Maybe so, but guess what? The four lowest premium price gaps belong to the four Atlantic provinces which all have regulated gasoline markets. Quebec also has a price regulation but it doesn’t appear to restrict retailers from sticking it to the rich bastards driving Lexuses. My French isn’t good enough and/or my patience isn’t good enough to allow me to wade through their regulation to find out what the details of their price constraints really are.

So where prices aren’t regulated (Quebec being an exception, big surprise) the “open unregulated marketplace” has determined that we can price gouge like crazy as long as we all do it together. Who is the “we” in that statement? Well, the CFA hastens to assure us that it isn’t just Esso and Shell, for example. They tell us that:

- 22 percent of all gas stations are price-controlled by Canada’s integrated refiner-marketers

- 78 percent of all gas stations are price-controlled by individual proprietors, or companies who are not involved in the refining process.

The big refiner-marketers set their retail price based on wholesale price (crude oil cost plus refiners operating margins plus taxes plus marketing margins), and they also sell it to small retailers who are free to establish their own retail price. Astonishingly, the major retailer prices are almost always the same, and even more surprisingly, the smaller retailers seem to independently land on almost the exact same number. (That was sarcasm, for those who didn’t get that)

It’s common on long weekends to hear people complaining about price increases. I’ve never paid much attention to that and I’ve never been convinced that there’s really a pattern of price gouging there. But I think that the astonishing BC refiners’ margin is relevant – it surely argues that gasoline retailers are ready, willing and able to gouge for excess profits wherever they can get away with it. And the difference between the regulated and unregulated provinces on premium gas pricing confirms that suspicion for me.

You might think that this would be illegal under Canada’s competition rules. And yes, collusion – price-fixing – is illegal. But, the Canada Competition Bureau reminds us, “the mere fact of prices moving in unison is not proof of price-fixing. In fact, there may be valid market forces causing gas prices in a given area to be similar. It is not illegal for gas stations to charge the same or similar prices as long as the station owners or operators have not agreed to do so…. To convict someone of price-fixing, we need to prove it. For that, we need evidence that shows they agreed to set prices.” I personally think that if it looks like a duck, and it walks like a duck, and it quacks like a duck, it’s probably not a robin. But sadly, I don’t have pictures or recordings, do I?

So there it is in a nutshell. Those price gouging bastards are taking advantage of us poor luxury car owners! I want price regulation now! Who stands with us? Free the modestly well off! (Doesn’t just have the right ring, does it?). I’ll try to do better next time.

2 responses to “Gas Price Gouging”

For what it’s worth, Doug Bethune, the automotive repair guru on Maritime Noon, routinely tells callers to ignore the different grades of gas and use the regular unleaded. If everyone did that, would premium prices come down? Or would regular unleaded gas prices to up?

My reading tells me that Mr Bethune needs to qualify his answer. If your car is designed for regular gas, you get no improved performance from going with the high test. If your owner’s manual “recommends” using high test gas, you can use regular, but you will lose some performance. If your owner manual says your car “requires” high test, you should stick with high test. If you don’t, your car might develop a knock, will certainly lose performance, and might reduce engine life.

Now, as to the economic question that you posed, I think the answer is that regular gas prices would stay much the same, and high octane prices would go up. That might seem counterintuitive, as the law of supply and demand which seemed to indicate that lowered demand for high octane, should result in a lower price. However, what would happen is that refineries would change the fraction of product that is high octane, and it will become even more of a specialty product than it is today, and they would jack the price up.

I don’t think regular unleaded price would go up, because it’s relatively easy for the refineries to switch there product mix, and because there would be pressure from the public and from regulators to keep the bulk gas prices low.