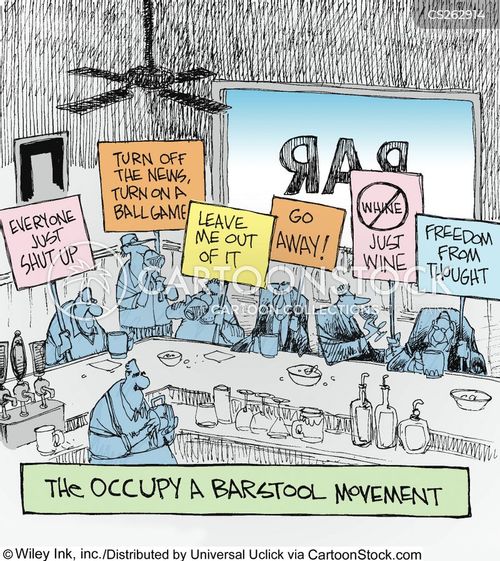

Recently the following little parable came to me in email that was distributed to our golf group. It was described as “humorous and worth the read.” Another member of the golf group suggested that I take a crack at looking at the meaning and accuracy of the parable entitled Bar Stool Economics. So I did. I’m sorry. Blame Peter.

***********************************************************************

Suppose that every day, ten men go out for beer and the bill

for all ten comes to $100. If they paid their bill the way we pay our

taxes, it would go something like this:

The first four men (the poorest) would pay nothing.

The fifth would pay $1.

The sixth would pay $3.

The seventh would pay $7.

The eighth would pay $12.

The ninth would pay $18.

The tenth man (the richest) would pay $59.

So, that’s what they decided to do. The ten men drank in the

bar every day and seemed quite happy with the arrangement, until one

day, the owner threw them a curve. ‘Since you are all such good

customers, he said, ‘I’m going to reduce the cost of your daily beer

by $20. Drinks for the ten now cost just $80.

The group still wanted to pay their bill the way we pay our

taxes so the first four men were unaffected. They would still drink

for free. But what about the other six men – the paying customers? How

could they divide the $20 windfall so that everyone would get his

‘fair share?’ They realized that $20 divided by six is $3.33. But if

they subtracted that from everybody’s share, then the fifth man and

the sixth man would each end up being paid to drink his beer. So, the

bar owner suggested that it would be fair to reduce each man’s bill by

roughly the same amount, and he proceeded to work out the amounts

each should pay.

And so:

The fifth man, like the first four, now paid nothing (100% savings).

The sixth now paid $2 instead of $3 (33%savings).

The seventh now paid $5 instead of $7 (28%savings).

The eighth now paid $9 instead of $12 (25% savings).

The ninth now paid $14 instead of $18 (22% savings).

The tenth now paid $49 instead of $59 (16% savings).

Each of the six was better off than before And the first four

continued to drink for free. But once outside the restaurant, the men

began to compare their savings.

‘I only got a dollar out of the $20’, declared the sixth man.

He pointed to the tenth man,’ but he got $10!’

‘Yeah, that’s right’, exclaimed the fifth man. ‘I only saved a

dollar, too. It’s unfair that he got ten times more than I!’

‘That’s true!!’ shouted the seventh man. ‘Why should he get $10

back when I got only two? The wealthy get all the breaks!’

‘Wait a minute,’ yelled the first four men in unison. ‘We

didn’t get anything at all. The system exploits the poor!’

The nine men surrounded the tenth and beat him up.

The next night the tenth man didn’t show up for drinks, so the

nine sat down and had beers without him. But when it came time to pay

the bill, they discovered something important. They didn’t have enough

money between all of them for even half of the bill!

And that, boys and girls, journalists and college professors,

is how our tax system works. The people who pay the highest taxes get

the most benefit from a tax reduction. Tax them too much, attack them

for being wealthy, and they just may not show up anymore. In fact,

they might start drinking overseas where the atmosphere is somewhat

friendlier.

David R. Kamerschen, Ph.D.

Professor of Economics, of

******************************************************************************

The first thing I did was to try to find out who David Kamerschen was, and what his background and biases might be. That search led me to a Snopes article about the Bar Stool Economics essay. It revealed that David Kamerschen has denied that he wrote the thing. Similarly, Professor Thomas Davies, to whom authorship has also been attributed, has also denied creating the document.

Snopes suggests that the earliest known version of the document was a letter to the Chicago Tribune by a gentleman named Don Dodson, but they note that he did not claim to be the original author and they suggest that he likely was not.

William F Buckley Junior put the document in his column in April of 2001, and suggested that it was intended as a direct analogue of tax cuts proposed by the administration under George W Bush. I would suggest that the murky past of the document and the link to the Bush tax cuts marks this as a clever piece of Libertarian right wing propaganda. But let’s think about what is inside the document.

First, please note that if ten guys are drinking for $100, they aren’t in the Rogers Centre or Scotiabank Arena.

I’m not going to worry too much about the math and exactly how that would work out in Canadian terms. The parable, in fact, drops off the rails immediately if you think about the math. It would have been quite possible for all six tax-payers to have their tax reduced by 20% and instead of worrying about what they get back (which is nothing!) they could be content to know that each of them benefited proportionately. You are not getting money from the bartender (the government), you are simply getting a 20% reduction in what you pay.

To understand the Canadian perspective, I looked at a database made available by Statistics Canada which gave me data on income and taxes paid for various income groups in 2020, the last year for which data is provided. The data says that the “bar stool tax treatment” isn’t very far off the Canadian experience.

I used a spreadsheet to extract data that wasn’t provided directly in the StatsCan data. For example, the top 50% income group includes the top 10%, and you have to do some math to figure out what the 11% to 50% group paid. Here are some fun findings from that research:

- The top 0.01% (I in 10000) incomes in Canada averaged $6.4M for 2875 individuals. They paid, on average $2.48M each, or 39% income tax rate and accounted for 2.65% of all income tax collected.

- The top 10%, including the .01% mentioned above, paid 49,200 tax on $176,700 income, an average tax rate of 28%, accounting for 52% of all taxes collected.

- The next lowest 40%, (so incomes from 50% to 89%), paid $9450 on average income of $63,800, for an average tax rate of 15%, accounting for 41% of taxes collected.

- The bottom 50% paid $1200, on average income of $22100, for a tax rate of 5%, accounting for 6.5% of Canada’s income tax revenue.

I will not talk about what is fair. There is no expectation of fairness in a tax system. We should expect the tax system to be reasonable, understandable and effective, but not fair. Fair is a totally subjective term and it doesn’t apply here. But what do we see here?

Well, there is no sense in trying to get more money from the bottom 50%. Those poor bastards are getting by on $22K per year. You can’t wring blood from a stone – in fact I wonder how they get by on income like that. If they work 2000 hrs per year, they’re getting paid $11/hr. So for the middle class (11-50%) or the upper income class to complain that they want more from the bottom is just silly. There’s no money there, so don’t bother trying to claw anything out of that source.

Second, our income tax system is looking pretty darnn effective. Despite what we hear and believe about the ultra-rich using loop-holes to avoid taxation, the top 10% are paying at a 38% average income tax rate. And according to this StatsCan data, we have close to 3000 taxpayers paying about $2.5 Million each.

Now, some more data for you. I found an interesting document from the OECD, the Organization for Economic Co-operation and Development, a consulting organization for 37 of the richest market-based democratic economies. In terms of total taxation for 2022, (not just income tax,) Canada’s tax to GDP ratio at 33.2% is almost bang on the OECD average at 34.1%. So, we are neither very heavily taxed nor very lightly taxed by OECD standards.

However, Canada’s tax collection methods are considerably different from those of the OECD average. The OECD document states “Relative to the OECD average, the tax structure in Canada is characterised by:

Substantially higher revenues from taxes on personal income, profits & gains, and higher revenues from taxes on corporate income & gains; payroll taxes; and property taxes.

» A lower proportion of revenues from value-added taxes and goods & services taxes (excluding VAT/GST), and substantially lower revenues from social security contributions.

Property tax (which affects home rental and home ownership cost) plus HST/GST and consumption taxes like gasoline tax account for 34% of Canada’s tax revenues. I highlight those particular items because they are things that bite at the $22K income in the bottom 50%. So, in the bar stool economics parable, where the bottom 50% aren’t buying their beer? Maybe not, but they’re stuck with the tip. It’s a tough story for the bottom 50%. They have low income and as a result, no savings capability. All their money gets spent, and it gets taxed coming in and going out leaving very little flexibility in disposable income.

When you think about it, savings capability is an important part of the economic story. If 50% of the people in the country have no possibility of saving and investing, then the income and wealth inequality gaps in this country are destined to continue to grow.

The point of the bar stool economics story was that Bush wanted to bring in tax cuts that would greatly favour the very rich more than the poor, and the middle class should shut up and accept it. They were supposed to feel grateful to the top decile guy for paying much more than his share, and they were supposed to feel that it was fair that he got a greater share of the tax cut than anyone else. And furthermore, they were supposed to understand the threat that the rich will leave them in the lurch if they protest about their good fortune in getting a big tax cut.

There is some data that substantiates the threat. In France, a wealth tax was abandoned because it caused a number of wealthy Frenchmen to become wealthy Belgians instead. However, by and large the threat is silly. A billionaire leaving Canada for another jurisdiction will be taxed by that jusrisdiction, and per the OECD data, it will be at about the same overall tax rate.

According to the Conference Board of Canada, “In Canada, only the fifth quintile—the group of richest Canadians—has increased its share of national income. All other quintile groups have lost share. This was particularly evident in the 1990s, when the income share for this top group jumped from 36.5 per cent in 1990 to 39.1 per cent in 2000.” For a long time, the rich have been getting richer in Canada, so they have no real reason to complain.

The top 10% of tax-payers in this country – in any country – have choices to make. If they don’t want to live in a country with homeless people sleeping on subway vents and beggars on every corner and high rates of property crime, then they have to pay. Why? Because they are the ones with the all the money! Because the top 50%, and especially the top 10%, of taxpayers have all the money, they will either bear the burden of a social safety net that makes this a great country to live in, or they will choose to change the nature of the country.

The great battle that is happening in the US, is a manifestation of that choice. The ultra rich – the dark money conspiracists led by the Koch brothers and people like the Coors family (don’t drink their beer) – are trying not to pay. They have chosen instead to change their country in fundamental ways. They are attacking the social structure of the United States to fatten their individual greedy needs. They are attacking medicare, supporting charter schools which benefit the rich, resisting all forms of environmental regulations, and working to disempower their federal government. The latest manifestation of this social change is that they are attacking child labour protections. A March 2023 report says “at least 10 states introduced or passed laws rolling back child labor protections in the past two years.”

If very rich people in this country decide to leave, let ‘em go. The rest of us will continue to work for the kind of country we want to live in.

Bottom line – this Bar Stool Economics parable is a propaganda piece for the wealthy sponsors of the alt-right in America, and it should be ignored. I would suggest that it should not be circulated any further.

3 responses to “The Bar Stool Economics Parable”

you are on the side of the angels

As usual, you are right on with your wisdom.

The people in power aka Trudeau and even the opposition aka Pollieve?sp would have a lot more credibility when they control how much all of us pay in taxes, if they set an example of honesty and fairness, without nepotism….but you never see that from those@#$%&’s

Also, there is so much cheating by everyone in the under ground economy….these cheats are the same as each one of us, if we were on the barstools, and never paid for the round when it is our turn.

This cheating wears down even honest people who eventually throw in the ‘bar towel’, becoming apathetic and stop caring

The underground economy is a complex problem, isn’t it? On the one hand, every cash transaction that avoids paying value added tax, shifts more of the burden on to other tax mechanisms, like income tax, and those tax mechanisms clearly hit the middle class. On the other hand, many of the service providers, taking money under the table, are in that lower 50%. And they’re not trying to be dishonest, they’re just trying to put food on the table. Who can blame them?